Business organizations: the private sector

There are five main forms of business organization in the private sector:

There are five main forms of business organization in the private sector:

- Sole traders

- Partnerships

- Private limited companies

- Public limited companies

- Co-operatives

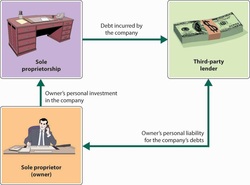

Sole trader is a business owned by one person.

Advantages:

Advantages:

- There are few legal regulations for him to worry about when he set up the business.

- He is the boss. He has complete control over his business and there is no need to consult with or ask others before making decisions.

- He has the freedom to choose his own vacations, hours of work, prices to be charged and whom to employ.

- Do not have the benefit of limited liability.

- Banks are often reluctant to lend large amounts to sole traders.

- Always likely to remain small.

- If sick or ill no one will take control of the business.

Limited liability the liability of shareholders in a company is only limited to the amount they invested.

A type of liability that does not exceed the amount invested in a partnership or limited liability company.

A type of liability that does not exceed the amount invested in a partnership or limited liability company.

Unlimited liability the owners of a business can be held responsible for the debts of the business they own. Their liability is not limited to the investment they made in the business.

Partnerships is a group or association of at least two people who agree to join and run a business together.

Advantages:

Advantages:

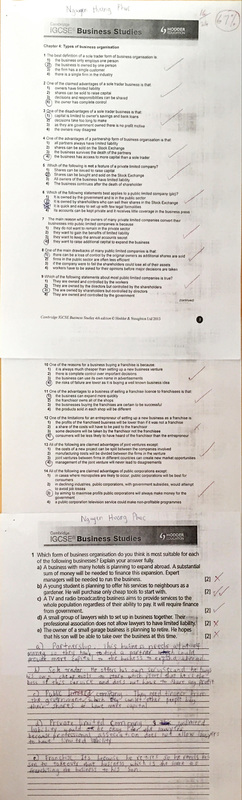

- More capital could be invested into the business.

- Responsibilities of running the business were now shared.

- Both partners are motivated to work hard because both of them benefit from the profits.

- Partners did not have limited liability.

- Partners can disagree.

- Limit the number of partners to 20.

Partnership agreement is the written and legal agreement between business partners, they do not have to make one but it is recommended.

Unincorporated business does not have legal identity, sole traders and partnerships are unincorporated business.

Incorporated businesses are companies that have separate legal status from their owners.

Shareholders are the owners of a limited company. They buy shares, represents part ownership of a company.

Private limited companies is often a small business such as an independent retailer in a market town. Shares do not trade on the stock exchanges

-Advantages:

-Advantages:

- Shares can be sold to a large number of people.

- All shareholders have limited ability.

- Able to keep control of it as long as they do not sell too many shares.

- Significant legal matters which have to be dealt with before a company can be formed.

- The Articles of Association - Rules concerning the election of directors and the holding of official meetings; and the procedure to be followed for the issuing of shares

- The shares in a private limited company cannot be sold or transferred to anyone else without the agreement of the other shareholders.

- The accounts of a company are less secret than for either a sole trader or a partnership.

- Most importantly for rapidly expanding businesses, the company cannot offer its shares to the general public. It will be possible to raise really large sums of capital to invest back into the business.

A public limited company

Is usually a large ,well known business .This could be a manufacture or chain of retailers with branches in most city centers. Shares trade on the stock exchange

- Advantages:

- Disadvantages:

Is usually a large ,well known business .This could be a manufacture or chain of retailers with branches in most city centers. Shares trade on the stock exchange

- Advantages:

- Legal identity

- Limited liability

- No reconstruction on selling shares

- Disadvantages:

- Legal formalities because it need a lot of money and time

- Some public limited growth so large difficult to control and manage

- Selling shares to the public is expensive

- Owners of business might become rich by selling shares in their business but they maybe lose control when someone richest buy many share . That shares more than owner . So this people will become owners

An Annual General meeting is a legal requirement for all companies .Shareholders may attend and vote on who they want to be on the Board of Directors for the coming years

Dividends are payment made to shareholder from the profits (after tax) of a company. They are the return to shareholders for investing in the company .

A Franchise is a business based upon the use of the brand names , promotional logos and trading method of an existing successful business

- Advantages to the franchiser:

- Advantages to the franchiser:

- The franchisee buys a license from the franchiser to use the brand name.

- Expansion of the franchised business is much faster than if the franchiser had to finance all new outlets .

- The management of the outlets is responsibility of the franchise.

- All product sold must be obtained from the franchiser.

- If one of many franchisee work not good and the customer don't like another franchiser.

- The franchisee keeps profit from outlet.

- Banks are often willing to lend to franchisees due to relatively low risk.

- The franchiser pays for advertising.

- The chances of business failure are much reduced because a well -known product is being sold.

Joint ventures is when two or more business agree to start a new project together , sharing the capital ,the risks and the profit.

- Advantages:

- Advantages:

- Sharing of cost - very important for expensive projects.

- Risks are shared.

- If joint ventures then you get local knowledge.

- If new project is successful , then profit has to be shares with partner.

- Two joint ventures partner might have different ways of running a business.